The Senate Health Committee voted almost unanimously Thursday to launch an investigation into the bankruptcy of Steward Health Care and subpoena its top executive for testimony.

The vote marked the first time the committee has ever issued a subpoena to compel testimony.

Steward Health Care CEO Ralph de la Torre will be required to face questions from the committee at a hearing on Sept. 12.

De la Torre for years has faced accusations that he has personally profited while Steward’s hospitals across the country have been failing financially, but he has so far avoided any public response. He declined an earlier opportunity to testify, lawmakers said, and offered no counter date or alternate company official.

Members voted 20-1 to authorize the investigation, and 16-4 to authorize the subpoena.

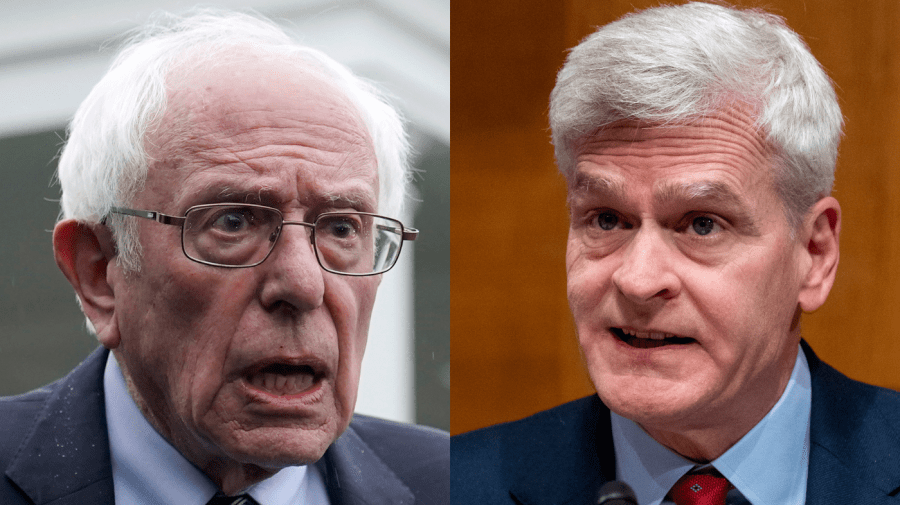

“Subpoenas should only be used when absolutely necessary, when all other efforts have failed, and the subpoena we’re voting on today meets that criteria,” said the panel’s top Republican, Sen. Bill Cassidy (La.). “The decision to subpoena Steward does not come lightly but the situation is actively impacting patients and the communities we represent.”

Committee Chair Sen. Bernie Sanders (I-Vt.) characterized Steward’s failure as an example of what happens when private equity firms get involved in health care.

Executives on Wall Street make “huge amounts of money by taking over hospitals throughout our country, loading them up with debt and stripping their assets,” Sanders said.

“Perhaps more than anyone else in America, a dubious distinction, no doubt, Ralph de la Torre, the CEO of Steward Health Care, epitomizes the type of outrageous corporate greed that is permeating throughout our for-profit health care system,” Sanders said. “The greed we are seeing here is quite extraordinary.”

Ahead of the vote, Sanders showed pictures of de la Torre’s $40 million yacht, $15 million luxury fishing boat, and the company’s two corporate jets.

“It is time for Dr. de la Torre to get off of his yacht and to explain to Congress the financial chicanery which made him extremely wealthy, while the hospitals he managed went bankrupt. It is time for Congress to hold Dr. de la Torre accountable for his extreme greed,” Sanders said.

Steward took over a failing hospital system run by the Archdiocese of Boston in 2010, and backed by private equity company Cerberus Capital Management, converted it into for-profit institutions before buying up hospitals across the country.

Cerberus siphoned money from the hospitals and then sold all the land to a real estate investment company for more than $1 billion. The company agreed to lease them back for millions of dollars in rent each year. Steward used the money from the deal to finance more expansion, allegedly without investing in its existing hospitals.

While the hospitals were struggling, to the point where bills weren’t being paid and medical instruments were being repossessed, the owners paid themselves millions in dividends.

But Cassidy countered that private equity was not to blame for Steward’s failure. The company went bankrupt because of corruption and mismanagement from top executives, he said.

“Steward is not a private equity firm. Private equity did not cause the situation we’re seeing today,” Cassidy said. “Blaming private equity for Steward’s mismanagement is not productive. It ignores that private equity invested hundreds of millions of dollars into failing hospitals, made them successful and then sold them to a private management team, which was not private equity.”

In a statement, Steward spokesperson Josephine Martin said the company “will address the subpoena with the appropriate HELP Committee staff. We understand the desire for increased transparency around our journey and path forward,” referring to the Senate Heath, Education, Labor and Pensions Committee.

The company previously blamed low government reimbursement rates for its financial troubles.

“Steward Health Care has done everything in its power to operate successfully in a highly challenging health care environment,” de la Torre said in a statement when Steward filed for bankruptcy reorganization in May.

The company is working to sell off all its hospitals during the bankruptcy proceedings.

Updated at 12:42 p.m. EDT